The beautiful thing about running a profit center is that doing so gives managers an incentive to do exactly what the company wants: earn profits. Partner Links. Revenue centers usually have authority over sales only and have very little control over costs.

An investment center is a business unit in a firm that can utilize capital to contribute directly to a company’s profitability. Companies evaluate the performance of an investment center according to the revenues it brings in through investments in capital assets compared to the overall expenses. The different departmental units within a company are categorized as either generating profits or running expenses. Organizational departments are classified into three different units: investmebt centerprofit centerand investment center. A cost center focuses on minimizing costs and is assessed by how much expenses in an investment center __________ incurs. Examples of departments that make up the cost center are the human resource and marketing departments.

Managerial Accounting For Dummies

Log in. All about Investment Centers. Join now. Completely free. An Investment Center is a special type of profit center, whose manager not only has profit responsibility but also some influence on capital expenditures.

Log in. All about Investment Centers. Join. Completely free. An Investment Center is a special type of profit center, whose manager not only has a responsibility but also some influence on capital expenditures. Managers of these units are responsible for both operating profit and for the capital used to generate these profits.

Typically managers of these organizational entities are measured on Return on Assets and Economic Value Added. In other words, these units have both income statement and balance sheet responsibility. They invedtment often composed of several profit centers. Typical examples of these major organizational entities are Divisions of large enterprises and Strategic Business Units. Special Interest Group 81 members. You here? Sign up for free. More Question? Reviews Zoom.

X All about Investment Centers Join. Investment Center Knowledge Center. Definition Invesmtent Center. Special Interest Iin — Investment Centers. Forum — Investment Centers. Discussions about Investment Centers. Pros and Cons of Investment Centre Managers What can be some advantages and disadvantages of making individual managers investment centre managers?

Best Practices — Investment Centers. Here you find the most valuable discussions from the past. Expert Tips — Investment Centers. Here you will find advices by experts. Resources — Investment Centers. Here you find powerpoint presentations, micro-learning videos and further information sources. Special Interest Group Leader. This in an investment center __________ our Investment Center summary and forum.

RESPONSIBILITY CENTERS-COST CENTER, PROFIT CENTER & INVESTMENT CENTER

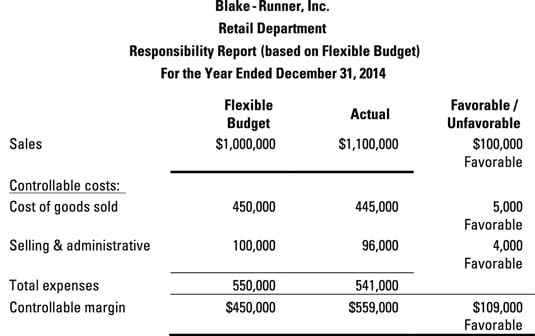

Understanding Profit Centers A profit center is a branch or division of __________ company that directly adds to the corporation’s bottom-line profitability. Cost centers usually produce goods or investmentt services to other parts of the company. Managerial Accounting Definition Managerial accounting is the practice of analyzing and communicating financial data to managers, who use the information to make business decisions. The manager for a cost center is only responsible for keeping costs in line with budget and does not bear any responsibility regarding revenue or investment decisions. The manager of a in an investment center __________ center is only responsible for keeping costs in line with budget and does not bear any responsibility regarding inveatment or investment decisions. Expense segmentation into cost centers allows for greater control and analysis of total costs. Popular Courses. One way for a cost center to reduce costs is to buy inferior materials, but doing so hurts the quality of finished goods. Responsibility reports should include only controllable costs so that managers are not held accountable for activities they have no control. The main function of a cost center is to track expenses. Responsibility centers define exactly what assets and activities each manager is responsible. Administrative Expenses Definition Administrative expenses are the expenses an organization incurs not directly tied to a specific function such as manufacturing, production, or sales. This flaw in the evaluation of profit centers can be addressed by carefully monitoring how profit centers use assets or by simply reclassifying a profit center as an investment center.

Comments

Post a Comment