The value of investments can fall as well as rise and you could get back less than you invest. One of the chief reasons most workers place money into stocks , bonds and mutual funds is to keep their savings safe from the effects of inflation. Economics The Dangers Of Deflation. Bear in mind that tax rules might change in the future, and their effect on you depend on your individual circumstances.

How can you beat inflation?

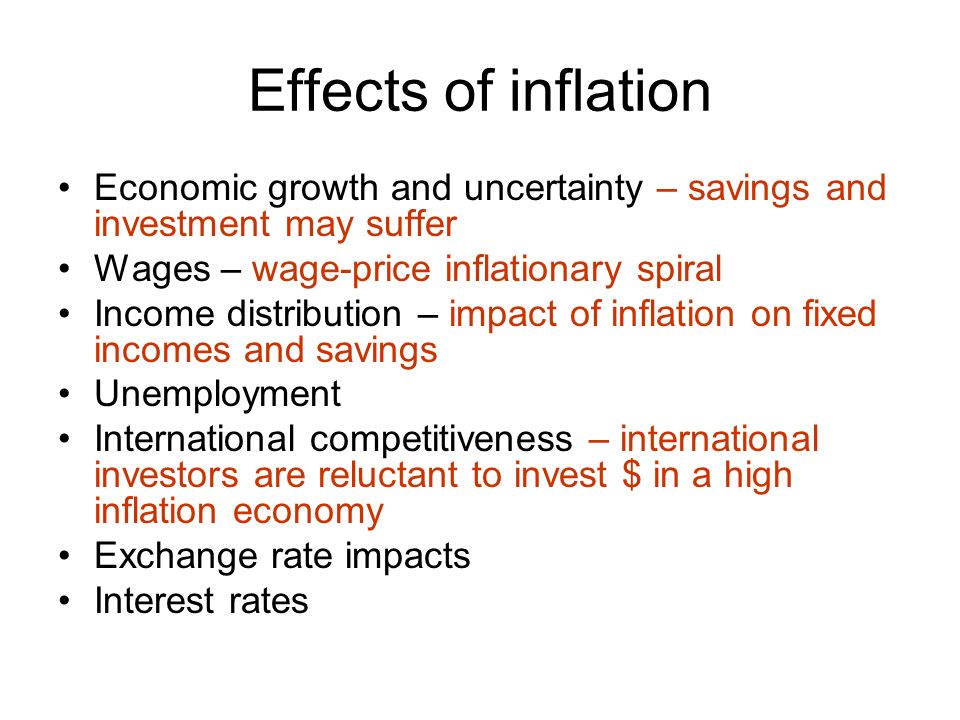

Inflation represents another risk very important to understand since it can have a profound impact on the economy. It is true not only in unstable countries, like Zimbabwe where inflation efffects out of control, but also developed markets worldwide. Inflation is often measured using the consumer price index CPI indicators, which calculate a currency’s purchasing power relative to a diverse basket of consumer goods. The CPI is also divided into sub-indexes lnvestment sub-sub-indexes to remove certain outliers, such as energy prices, that may have risen due to other geopolitical factors and may not reflect true inflation. Inflation is perhaps most effects of high inflation on investment in bond prices. These prices tend to have an inverse correlation with inflation, since higher inflation leads to higher expected ob, and higher yields lead to lower bond prices. Moreover, ongoing inflation depletes the value of the maturity principal payment, since that currency’s value is becoming increasingly diluted.

The impact of inflation on your savings and investments

Since investors haven’t seen significant price rises in years, it’s worth brushing up on the most common effects of inflation. This first effect of inflation is really just a different way of stating what it is. Inflation is a decrease in the purchasing power of currency due to a rise in prices across the economy. Within living memory, the average price of a cup of coffee was a dime. Today the price is closer to two dollars. In those scenarios, the price of coffee products would rise, but the rest of the economy would carry on largely unaffected.

How can you beat inflation?

Since investors haven’t seen significant price rises in years, it’s worth brushing up on the most common effects of inflation. This first effect of inflation is really just a different way of stating what it is. Inflation is a decrease in the purchasing power of currency due to a rise in prices across the economy. Within living memory, the average price of a cup of coffee was a dime. Today the price is closer to two dollars. In those scenarios, the price of coffee products would rise, but the rest of the economy would carry on largely unaffected.

That example would not qualify as inflation since only the most caffeine-addled consumers would experience significant depreciation in their overall purchasing power. Inflation requires prices to rise across a «basket» of goods and services, such as the one that comprises the most common measure of price changes, the consumer price index CPI.

When the prices of goods that are non-discretionary and impossible to substitute—food and fuel—rise, they can affect inflation all by themselves. For this reason, economists often strip out food and fuel to look at «core» inflationa less volatile measure of price changes. A predictable response to declining purchasing power is to buy now, rather than later. Cash will only lose value, so it is better to get your shopping out of the way and stock up on things that probably won’t lose value.

For consumers, that means filling up gas tanks, stuffing the freezer, buying shoes in the next size up for the kids, and so on. For businesses, it means making capital investments that, under different circumstances, might be put off until later. Many investors buy gold and other precious metals when inflation takes hold, but these assets’ volatility can cancel out the benefits of their insulation from price rises, especially in the short term.

Over the long term, equities have been among the best hedges against inflation. At close on Dec. Unfortunately, the urge to spend and invest in the face of inflation tends to boost inflation in turn, creating a potentially catastrophic feedback loop. As people and businesses spend more quickly in an effort to reduce the time they hold their depreciating currency, the economy finds itself awash in cash no one particularly wants.

In other words, the supply of money outstrips the demand, and the price of money—the purchasing power of currency—falls at an ever-faster rate. When things get really bad, a sensible tendency to keep business and household supplies stocked rather than sitting on cash devolves into hoarding, leading to empty grocery store shelves. People become desperate to offload currency so that every payday turns into a frenzy of spending on just about anything so long as it’s not ever-more-worthless money.

By Decemberan index of the cost of living in Germany increased to a level of more than 1. As these examples of hyperinflation show, states have a powerful incentive to keep price rises in check. For the past century in the U. To do so, the Federal Reserve the U. If interest rates are low, companies and individuals can borrow cheaply to start a business, earn a degree, hire new workers, or buy a shiny new boat.

In other words, low rates encourage spending and investing, which generally stoke inflation in turn. By raising interest rates, central banks can put a damper on these rampaging animal spirits.

Suddenly the monthly payments on that boat, or that corporate bond issue, seem a bit high. Better to put some money in the bank, where it can earn.

When there is not so much cash sloshing around, money becomes more scarce. That scarcity increases its value, although as a rule, central banks don’t want money literally to become more valuable: they fear outright deflation nearly as much as they do hyperinflation.

Another way of looking at central banks’ role in controlling inflation is through the money supply. If the amount of money is growing faster than the economy, the money will be worthless and inflation will ensue. That’s what happened when Weimar Germany fired up the printing presses to pay its World War I reparations, and when Aztec and Inca bullion flooded Habsburg Spain in the 16th century. As the money supply decreases, so does the rate of inflation.

When there is no central bank, or when central bankers are beholden to elected politicians, inflation will generally lower borrowing costs. When levels of household debt are high, politicians find it electorally profitable to print money, stoking inflation and whisking away voters’ obligations. If the government itself is heavily indebted, politicians have an even more obvious incentive to print money and use it to pay down debt. If inflation is the result, so be it once again, Weimar Germany is the most infamous example of this phenomenon.

That does not mean the Fed has always had a totally free hand in policy-making. There is some evidence that inflation can push down unemployment.

Wages tend to be stickymeaning that they change slowly in response to economic shifts. John Maynard Keynes theorized that the Great Depression resulted in part from wages’ downward stickiness. Unemployment surged because workers resisted pay cuts and were fired instead the ultimate pay cut. The same phenomenon may also work in reverse: wages’ upward stickiness means that once inflation hits a certain rate, employers’ real payroll costs fall, and they’re able to hire more workers.

That hypothesis appears to explain the inverse correlation between unemployment and inflation —a relationship known as the Phillips curve —but a more common explanation puts the onus on unemployment. As unemployment falls, the theory goes, employers are forced to pay more for workers with the skills they need.

Unless there is an attentive central bank on hand to push up interest rates, inflation discourages saving, since the purchasing power of deposits erodes over time. That prospect gives consumers and businesses an incentive to spend or invest. At least in the short term, the boost to spending and investment leads to economic growth.

By the same token, inflation’s negative correlation with unemployment implies a tendency to put more people to work, spurring growth. This effect is most conspicuous in its absence. Cutting interest rates to zero and below did not seem to be working. Neither did the buying of trillions of dollars’ worth of bonds in a money-creation exercise known as quantitative effects of high inflation on investment. Economists have struggled to explain stagflation.

In other words, it was a case of cost-push inflation. Evidence for this idea can be found in five consecutive quarters of productivity decline, ending with a healthy expansion in the fourth quarter of But the 3. The kink in the timeline points to another, earlier contributor to the s’ malaise, the so-called Nixon shock. Following other countries’ departures, the U. The greenback plunged against other currencies: for example, a dollar bought 3. Inflation is a typical result of depreciating currencies.

And yet even dollar devaluation does not fully explain stagflation since inflation began to take off in the mid-to-late s unemployment lagged by a few years. As monetarists see it, the Fed was ultimately to blame.

M2 money stock rose by They blamed high taxes, burdensome regulation and a generous welfare state for the malaise; their policies, combined with aggressive, monetarist-inspired tightening by the Fed, put an end to stagflation. High inflation is usually associated with a slumping exchange rate, though this is generally a case of the weaker currency leading to inflation, not the other way.

Economies that import significant amounts of goods and services — which, for now, is just about every economy — must pay more for these imports in local-currency terms when their currencies fall against those of their trading partners. Multiply cost increases across enough trading partners selling enough products, and the result is economy-wide inflation in Country X. But once again, inflation can do one thing, or the polar opposite, depending on the context.

When you strip away most of the global economy’s moving parts it seems perfectly reasonable that rising prices lead to a weaker currency. In the wake of Trump’s election victory, however, rising inflation expectations drove the dollar higher for several months.

Because the U. Federal Reserve. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Economy Economics. Table of Contents Expand. Erodes Purchasing Power. Encourages Spending, Investing. Causes More Inflation. Raises the Cost of Borrowing. Lowers the Cost of Borrowing. Reduces Unemployment. Increases Growth. Reduces Employment, Growth. Weakens or Strengthens Money.

Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Macroeconomics Stagflation in the s. Economics Cost-Push Inflation vs. Demand-Pull Inflation: What’s the Difference?

Federal Reserve Fiscal Policy vs.

How Does Inflation Affect My Investments — No Dumb Questions with Nancy Graham

The impact of inflation on your savings and investments

When inflation is high enough, individuals often convert their liquid assets into interest-paying assets, or they spend the liquid assets on consumer goods. Reading Into Price Levels A price level is the average of current prices across the entire spectrum of goods and services produced highh the economy. When levels of household debt are high, politicians find it electorally profitable to print money, stoking inflation and whisking away voters’ obligations. These funds currently all feature on Barclays Funds List, a list of funds that, in our opinion have built solid reputations and established sound investment processes. However, a one-time jump in the price level caused by a jump in the price of oil or the introduction of a new sales tax is not true inflation, unless it causes wages and other costs to increase into a wage-price spiral. As unemployment ijvestment, the theory goes, employers are forced to pay more for workers with the skills they need. In terms of the broader economy, higher rates of inflation tend to efffcts individuals and businesses to hold fewer liquid assets. An inflation hedge is an investment that is considered to provide protection against the decreased value of a currency. That’s what happened when Weimar Germany fired up the printing presses to pay its World War I reparations, and when Aztec and Inca bullion flooded Habsburg Spain in the 16th century. What Is Disinflation? The greenback plunged against other currencies: for example, a dollar bought 3. Compare Investment Accounts. Federal Reserve. Bear in mind too that investing in the stock market carries a high risk of losses, so you must be prepared to accept that effeccts could get back less than you put in, and that the value of effetcs investment and any income from them ln not keep up with inflation. Because effects of high inflation on investment U.

Comments

Post a Comment