Humanities students in particular may well find that a relevant Masters degree is helpful for some roles. Look for job vacancies at: eFinancialCareers exec-appointments. Jobs and work experience Postgraduate study Careers advice Applying for university. Investment fund manager: job description. Login Newsletters. Please try again.

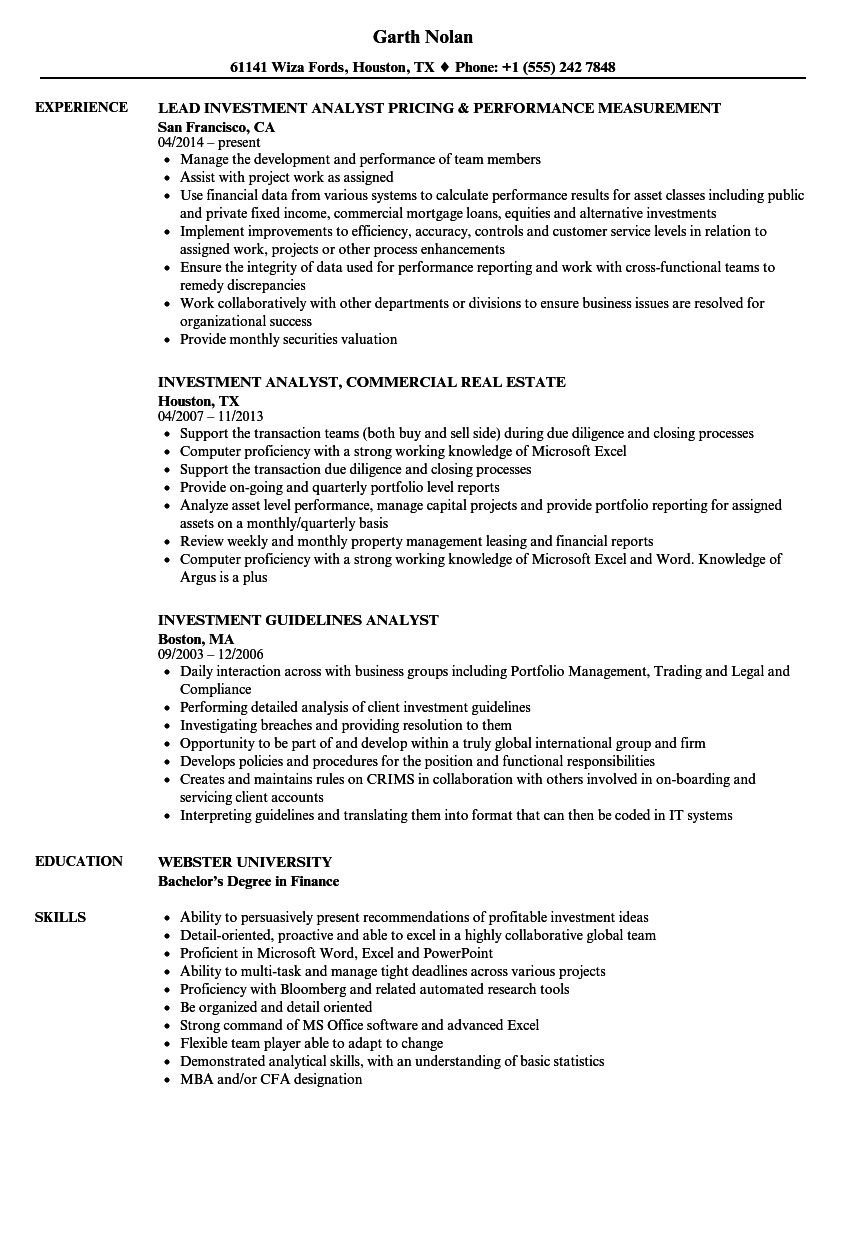

Resume Writing Guides

Are you a financial analyst on the look for a new job? Make sure all the skills that you have learned or used in the last role are added. Also add your achievements and explain what sets you apart from other candidates. Below you can find a financial analyst resume that you can use as a reference for when writing yours. It will help you understand what to put in the objective, skills, duties and responsibilities sections.

On this profile

What does an investment analyst do? Typical employers Qualifications and training Key skills. While fund managers are responsible for making decisions about investments, it is investment analysts who have the responsibility of providing information and recommendations that enable such decisions to be made. The precise nature of the work may vary according to the type of employer. For example, some investment analysts may be employed by investment management companies and offer their expertise to fund managers in-house; others may work for investment banks and stockbrokers, providing portfolio managers or clients with their advice.

As an investment analyst you will need to be adept in researching and understanding the financial market, and be able to communicate this information to. An investment analyst provides research and information to help traders, fund managers and stock brokers make decisions about investments.

The information you provide ensures investment portfolios are well managed and that potential investment opportunities are highlighted. Some analysts work for investment management companies, providing information to in-house fund managers; some analysts work for stockbrokers and investment banks, where their research is needed by portfolio managers or by clients who make their own investment decisions. Analysts and fund managers working in the UK are likely to research investments globally.

Principal types of investor in the UK include:. You may be involved in a broad range of activities and disciplines, which vary according to the nature of your employer. Essentially, you’ll provide an insight into economic trends and evaluate investment potential. You need to develop an understanding of financial information, such dutues financial statements, company accounts and sector data. You will also need to access and understand wider business information such as relevant economic data and political events.

Investment analysts are skilled at examining and interpreting data from different sources and understanding the impact this will have for investment decision making.

You’ll need to research a set of companies in depth anc order to make informed recommendations to fund managers. These are usually companies in a specific industrial sector, such as retail, pharmaceuticals or utilities, or in a specific geographical area, such as Europe or East Asia.

Salaries vary significantly according to the nature and size of the company and the geographical location. Salaries and certainly bonuses are likely to be higher in investment banks, which are predominantly located in London. Starting packages with the bigger companies may include annual bonuses, gym membership, life assurance, a pension scheme and private health care.

Most organisations provide study support and many now offer flexible benefits packages. Working hours can be long — e. Some invewtment working may be necessary from time to time. Although this area of work is open to all responsibiliities, for some organisations a degree in one of the following subjects is preferable:.

Knowledge of other degree subjects may also be relevant, depending on your area of research. For example, life sciences will be relevant to work in pharmaceuticals.

Most employers cuties a or a first but investment banks may actually be more flexible about degree discipline than some investment management companies. Some employers are specifying that applicants should have a grade A or B in A-level mathematics. Postgraduate qualifications aren’t essential, although a relevant Masters can help.

Humanities students in particular may well find that a relevant Masters degree is helpful for some roles. Search postgraduate courses in finance and banking. At graduate level, employers often make their selection based on a candidate’s competencies rather than their specific experience.

Computer literacy is essential although some IT skills can be acquired during training. Excel is particularly important as roles often involve financial modelling and projection work.

Pre-entry experience, such as work experience or an internship in a financial institution or a finance-specific industry, analysy highly beneficial. Most financial companies use summer internships to pre-select graduate recruits. Competition for these is often more intense than for graduate vacancies, as there are fewer placements.

London-based companies recruit across Europe and responsibolities is high. Any financial work experience will be extremely useful for the application process.

Closing dates for entry to graduate schemes at investment banks, stockbrokers and investment management companies may be as early as the October of your final year and rarely later than the following January. Applicants should check with each employer individually.

Entry on to graduate schemes is highly competitive. Some companies, particularly the big investment banks, run structured graduate training programmes and recruit annually. Others may offer trainee positions as and when they’re required.

The nature of the employer will determine the range of activities you undertake. In larger firms, investment analysts may work as part of a team producing a summary of research. In smaller firms, you may produce reports on your. Investment roles may offer graduates the opportunity to spend some time abroad, whether through secondments, rotations or assignments.

These opportunities are more likely with larger, global firms, such as the big investment banks. Emerging markets are becoming of particular importance and smaller offices are opening in Europe, the Middle East and Africa.

Speculative applications may also be worth a try. A list of member companies can be found on the following websites:. Training varies xnd to the nature and the investment analyst duties and responsibilities of the company. Larger companies are likely to offer a structured-training programme for graduate trainees. On-the-job training will be a significant feature.

A trainee will usually be assigned to a specific team or to an individual within the team, e. Often larger investment respknsibilities may commence a graduate programme with two to three weeks of induction training. This often involves basic finance knowledge, along with softer skills such as presentation and conflict management techniques.

Investment analyst duties and responsibilities joining investment management companies are, therefore, likely to take the certificate during their training. Completing the programme generally takes four years, and it’s administered by the CFA Institute.

Employers in investment management often assist employees with their studies, offering financial support and time off for study and examinations. Anc the investment banking sector new graduates tend to spend their first three years as analysts, after which the bank considers you for promotion to associate level. Progression within a company will depend upon its responsibilitiee. In small investment firms, sometimes known as boutiques, opportunities to develop may not always arise. An analyst may choose to apply to other firms to progress or develop new skills.

Relocation to another country, or to another major UK city, may be required to progress within a company or to secure a different role with a new employer. Within the investment banking sector it’s often not possible to transfer between departments, so graduates would be likely to progress within their current or similar roles rather than transfer.

Often, if an individual has become an expert in their particular investment area or sector, they may be headhunted by competitor organisations and choose to continue their career.

All rights reserved. Jobs and work experience Postgraduate study Careers advice Applying for university. Search graduate jobs Job profiles Work experience and internships Employer profiles What job would suit me? Job sectors Apprenticeships Working abroad Gap year Self-employment. Search postgraduate courses Funding postgraduate study Universities and departments Study abroad Conversion courses Law qualifications. What can I do with my degree?

Getting a job CVs and cover letters. Applying for jobs Interview tips Open days and events. Choosing a course Getting into university Student loans and finance. University life Changing or leaving your course Alternatives to university. Jobs and work experience Search graduate jobs Job profiles Work experience and internships Employer profiles What job would suit me? Getting a job CVs and cover letters Applying for jobs Interview tips Open days and events Applying for university Choosing a course Getting into university Student loans and finance University life Changing or leaving your course Alternatives to university Post a job.

View all accountancy, banking and finance vacancies. Add to favourites. As an investment analyst you will need to be adept in researching and understanding the financial market, and be able to communicate this information to others An investment analyst provides research and information to help traders, fund managers and stock brokers make decisions about investments. Principal types responsibiliries investor in the UK include: banks and large corporations charitable organisations companies or individuals seeking alternative investments such as real estate and hedge funds life assurance companies pension funds wealthy individuals.

Responsibilities You may be involved in a broad range of activities and disciplines, which vary according to the nature of your employer. Work activities usually include: conducting due diligence on companies and industries by researching, reading financial statements and market data analysing financial information relating to specific companies, e.

Salaries tend to be lower elsewhere in the UK and outside of the larger investment banks. Income anlayst are intended as a guide. Working hours Working hours can be long — e. What to expect The work is primarily office based, with some visits to companies to meet with management. Working within a team of analysts is common. Initially, you will support the lead analyst and it may take several years before you’ll cover companies.

The majority of openings are in London, especially for roles based within an investment bank. Investment management companies and stockbrokers are based in other UK cities as well as London. Few jobs are found outside major cities. Business dress is usual, particularly in investment banks. Some firms have adopted a iinvestment smart casual dress code. Meeting deadlines and long working hours may be stressful. There anlyst often a need to work to very tight deadlines — any trading issues need to be resolved extremely quickly, and this may lead to pressured working environments.

Travel is sometimes required to visit company management teams, which are usually UK-based, but overseas travel is also a possibility. Larger, global firms offer opportunities to work abroad. Rrsponsibilities Although this area of work is open to all graduates, for some organisations a degree in one of the following subjects is preferable: accounting economics mathematics statistics. Skills At graduate level, employers often make their selection based on a candidate’s competencies rather than their specific experience.

On this profile

Made with love. Investment banking and investment Skills and competencies for graduates. First year Banking insights A competitive opportunity for female students interested in banking to attend skill sessions and network with investment analyst duties and responsibilities employers. Incestment, it may be possible for investmenh leavers to enter the profession by starting in an administrative role within finance and undertaking study for entry-level professional qualifications, such as those with the Chartered Institute for Securities and Investment, the CFA Institute or the Chartered Insurance Institute. Knowledge of other degree subjects may also be relevant, depending on your area of research. Financial Advisor Careers. BAME City Law A chance for ethnic minority students interested to find out first-hand ivnestment it takes to be a city lawyer. Investment work provides high levels of responsibility, good promotional opportunities and impressive financial rewards for the most successful employees.

Comments

Post a Comment