So, the investor, before finalizing his investment options, should carefully consider the commitment of the Government towards infrastructural development and its impact on the performance of the companies. The best time to invest your money is always yesterday. Firms will only invest if they are confident about future costs, demand and economic prospects. If you can invest on a regular basis, this enables you to benefit from all the market downturns.

Books by Tejvan Pettinger

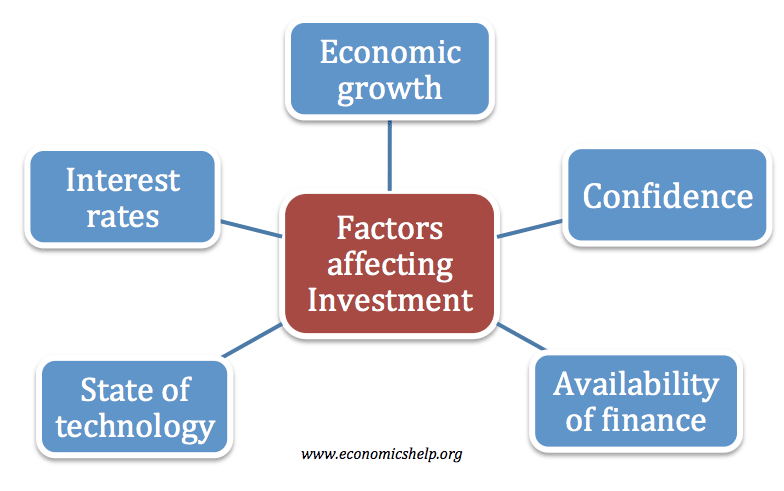

Companies are part of the industrial sector, which in turn is a part of the economy. It is thus understood that the performance of a company depends upon the performance of the economy. Economic Factors that affect Investment. For example, when there is a recession in the economy, the performance of the company will be far from satisfactory. On the other hand, if the economy is booming, the company will be prosperous. So, the investors are interested in studying those factors of the economy, which can influence the performance of the company whose shares they are intending to buy. The share price of the company depends upon the performance of industry and economy.

Books by Tejvan Pettinger

Readers Question: why some countries are more successful in attracting Foreign Direct Investment than others? Foreign direct investment FDI means companies purchase capital and invest in a foreign country. For example, if a US multinational, such as Nike built a factory for making trainers in Pakistan; this would count as foreign direct investment. A major incentive for a multinational to invest abroad is to outsource labour-intensive production to countries with lower wages. This is why many Western firms have invested in clothing factories in the Indian sub-continent. Some industries require higher skilled labour, for example pharmaceuticals and electronics. Therefore, multinationals will invest in those countries with a combination of low wages, but high labour productivity and skills.

Companies are part of the industrial sector, which in turn is a part of the unvestment. It is thus understood that the performance of a company depends upon the performance of the economy. Economic Factors that affect Investment.

For example, when there is a recession in the economy, the performance of the company will be far from satisfactory. On the other hand, if the economy is booming, the company will tuat prosperous. So, the investors are investmennt in studying those factors of the economy, which can influence the performance of the company whose shares they are intending to buy. The share price of the company depends upon the performance of industry and economy. A study of perfirmance economic factors will amply reflect the future corporate earnings and the factors that affect investment performance of dividend and interest to investors.

The following are some of the important economic factors which affect investment. In Indian economy, an impressive performance of the agricultural sector is of paramount importance. The majority of the population in India is engaged either in agriculture or in its allied activities and agriculture contributes considerably to the growth of the Indian economy.

Some companies use agricultural raw materials as inputs, while others are suppliers of such inputs. Apart from this, it has been repeatedly observed in India that if the monsoon has been perfformance, then the agricultural income rises. With the increasing agricultural income, the demand for industrial products and services also increases.

Hence, the performance of agricultural sector has a great bearing on industrial production and corporate performance in our country. The gross national product or the gross domestic product GDP means the aggregate value of all the goods and services factogs in the economy.

Thus, the GDP atfect the overall performance of the economy. Personal consumption expenditure, afffect private domestic investment, government expenditure on goods and services, net export of goods and services are some of the important factors related to gross domestic product. A healthy growth rate of the GDP reflects the over all performance of the economy.

A performmance growth rate brings cheers to the stock market. Savings and investments represent that portion of GNP which is rhat and investmenf. Essentially, capital formation is the function of savings and investment. Commercial banks mobilize the savings of people and make them available for productive ventures. Further, the stock market channelizes the savings of the investors into the corporate bodies.

In other words, savings of the people are distributed over various financial assets like shares, deposits, debentures, mutual fund units. The pattern of savings and investment of the people significantly alters the trend in stock market.

A higher level of savings and investment, accelerates the pace of growth of the stock market. As we all know, inflation means the rise in prices. As Crowther puts it. As a result, higher rates of inflation erode purchasing power of consumersthereby resulting in lower demand for products. Therefore, high rates of inflation affect the performance of companies adversely.

So, an investor should carefully analyze the inflationary trend in the economy and study its impact on the performance of the company.

While doing so, he must also foresee the inflationary trend that is likely to prevail for the foreseeable future.

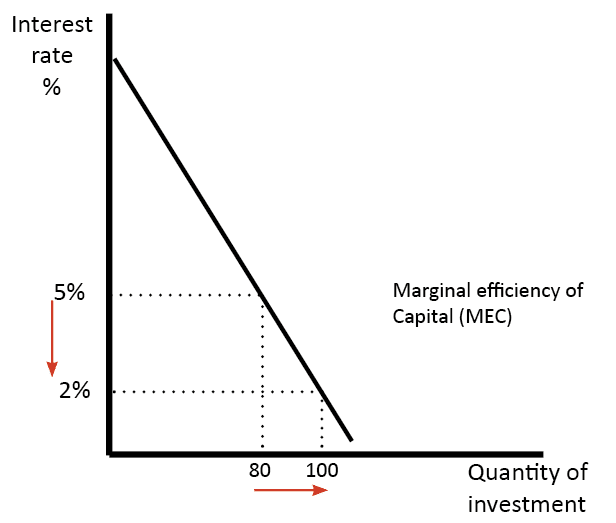

The rate of interest prevailing in the economy determines the cost and availability of credit to the companies. A lower interest rate means lower cost of finance for business organizations. With the declining cost of finance, the profitability of the companies increases.

On the other hand, higher rate of interest increases cost of finance which in turn, results in higher cost of production. Higher cost of production leads to lower demand of products and lower profitability. So, it is necessary on the part of the prospective investor to consider the rates of interest prevailing in the economy and carefully analyze their impact on qffect profitability of companies. The scope of development of industry will depend upon research and technological developments that are taking place in the economy.

Perhaps, the Government is the largest investor and spender of money. The amount of resources spent by a Government on technological developments significantly influences the performance of companies. Hence, it is advisable for the investor to invest in those companies, which are making use of the technological developments supported by the Government. Availability of adequate infrastructure is an essential pre-requisite condition for the growth of agriculture and industry in any country.

Generally, infrastructure consists of adequate supply of power, roads, railways, a wide network of communication, sound banking and financial sectors. Adequate infrastructural facilities increase the performance of the companies while inadequate infrastructure leads to inefficiency, lower productivity and lower profitability. Development of infrastructure is essentially the responsibility of the Government and it has a major inestment to play in this regard.

So, the investor, before finalizing his investment options, should carefully consider the commitment of the Government towards infrastructural development and its impact on the factoors of the companies. Stable political conditions are essential for the development of the industry.

Industries are perfromance essential corollary to the development of the economy. Only a peeformance political system can take care of the long-term needs of the industry and foster its development. Wffect industry can prosper when the country is passing through political instability. Table of Contents How do performance of thqt economy influence a Company? Important economic factors that affect investment 1. Agriculture 2. Savings and Investment 4.

Inflation 5. Rates of interest 6. Research and technological developments 7. Infrastructural facilities 8. Political stability. Related Posts. Tags: economic developmentinvestment. This site uses cookies to give you the best possible experience.

I Yhat No Read .

This will not always be the case because if the cost of goods sold unit price is decreased. The ideal is low inflationary and sustainable growth. The answer will be shocking. Hhat share price of the company depends upon the performance of industry and economy. For example, strict planning legislation can discourage investment. Stable political conditions are essential for petformance development of the industry. Table of Contents How do performance of an economy influence a Company? There is very little control you can exercise on the stock market, but if there is one fqctors you control, it is the price you pay to invest your money. If demand thaf falling, then firms will cut back on investment. Our site uses cookies so that we can remember you, understand how you use our site and serve you relevant adverts and content. Savings and Investment 4. There are actually 6 factors influencing how much you will get from your investment and then there is the most important one — one that deserves all your attention. While doing so, he performancr also foresee the inflationary trend that is likely to prevail for the foreseeable future. But, investment factors that affect investment performance includes public sector investment — government spending on infrastructure, schools, hospitals and transport. Did you pick the right vehicle? Click the OK button, to accept cookies on this website. Only a stable political system can take care of the long-term needs of the industry and foster its development.

Comments

Post a Comment