Here’s how investors can find out, although Dave might not tell them this. This area of the market was one of the worst during the to bear market. One of the most fundamental aspects of asset allocation is to have more than one asset type. In his investment philosophy, Dave says to use Class A shares loaded funds , which means the investor pays commissions to a broker or investment adviser in an IRA or brokerage account. Dave is taken to task on these issues by financial professionals for a variety of reasons.

How Do You Make Money From Mutual Funds?

Knowing how to deal with debt is easy—pay it off! Just remember, investing is personal. Your income is your most important wealth-building tool. After all, avoiding a financial crisis with a fully funded emergency fund and paying off debt are fantastic investments! Does your workplace offer a Roth k? Just be sure it offers plenty of good mutual fund options so you can make the most of your investment. Work with a financial consultant to compare all your options before choosing your investments.

Decide for Yourself

For instance, Ramsey suggests the snowball method of debt repayment but the stacking method is superior when it comes to saving money on your debt. But if you follow the snowball method, you will pay off your debt. So we say potato and Dave says potato but we both get you to debt free in the end. However, there is a big, however. His investment philosophy is conservative, to say the least. It is heavy on cliches I counted four and light on advice or even basic information like explaining different types of investments.

Mutual Funds Facts and Myths

What Does Dave Ramsey Invest In?

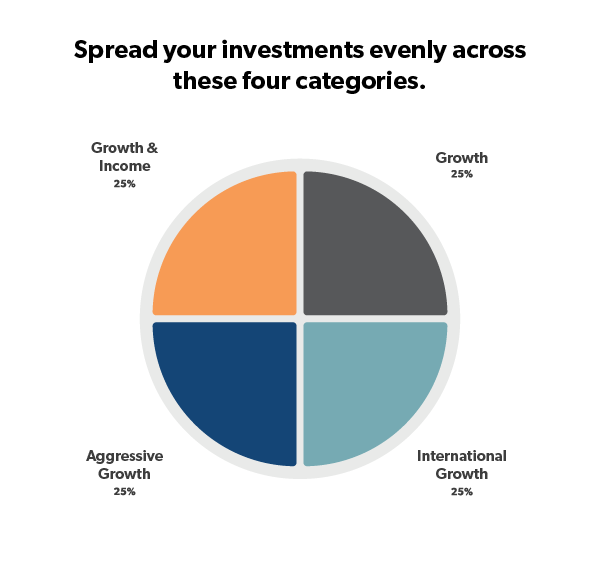

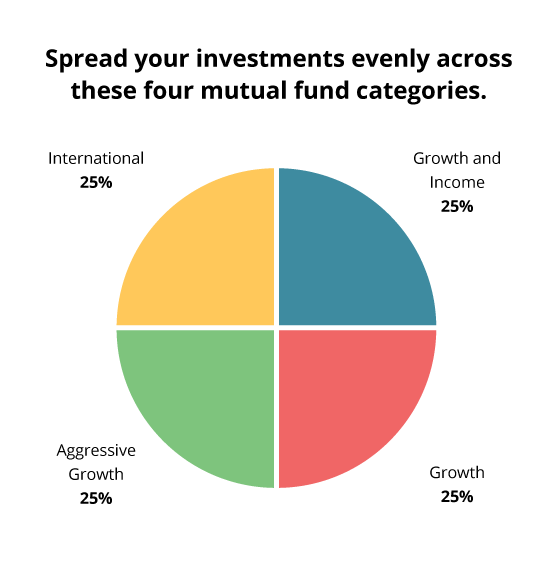

I hear Bernie Madoff got a lot of clients via word of mouth. He sells financial services. Following Dave’s example, imagine an inexperienced investor looking at a k plan that offers Vanguard mutual funds. To support the decision to hire an advisor, one can look at the Bible to warrant this position. Time is measured in months or years, and tolerance is an attitude, feeling, or emotion mutual fund investing dave ramsey the ups and downs of your account balance. It might even seem possible to just follow Dave’s mutual fund allocation strategy, and call it the day. So one can understand the risks, saw a Continue Reading. A home is not a liquid investment. Candice has answered thousands of questions from the LMM community and spent countless hours doing research for hundreds of personal finance articles. I am now stepping out of line in criticizing Dave Ramsey. Know the definition of risk tolerance : As I said on page one of this article, Dave is completely wrong on the meaning of low risk tolerance. Retirement is a numbers game, but you need to know what your number is. This four-fund mix has great potential for overlapwhich occurs when an investor owns two or more mutual funds that hold similar securities. Read his strategy and our Investing Blueprint and see which you think is better.

Comments

Post a Comment