Explore contribution limits and learn how much you can contribute to your plan. Tax-deferred annuity plans or TDAs are tax-deferred retirement plans available to employees of community colleges, state colleges, universities, and other qualified individuals employed in an educational capacity including the Board of Higher Education. As interest rates rise, bond prices usually fall, and vice versa. To Enroll Now: Obtain your 5 digit plan number, contact Fidelity at or your benefits office. Choose your Investments.

Explore Plans & Investments

Privacy Terms. Time: 0. Quick links. No matter how simple or complex, you can ask it. I am strongly thinking about transferring Roth to Fidelity since my current employer account is fidelty not sure if I will have to pay fees for transferring account from Mainstay???

Make Updates To My Account

With no annual fees, and some of the most competitive prices in the industry, we help your money go further. From complex wealth management to your retirement needs, we can help you with financial planning. Get easy-to-use tools and the latest professional insights from our team of specialists. Knowing where you stand is crucial. Use this tool to see how prepared you are for retirement, and what steps you may need to work on. Get your score now.

How to Invest in Mutual Funds with Fidelity

Why invest with Fidelity

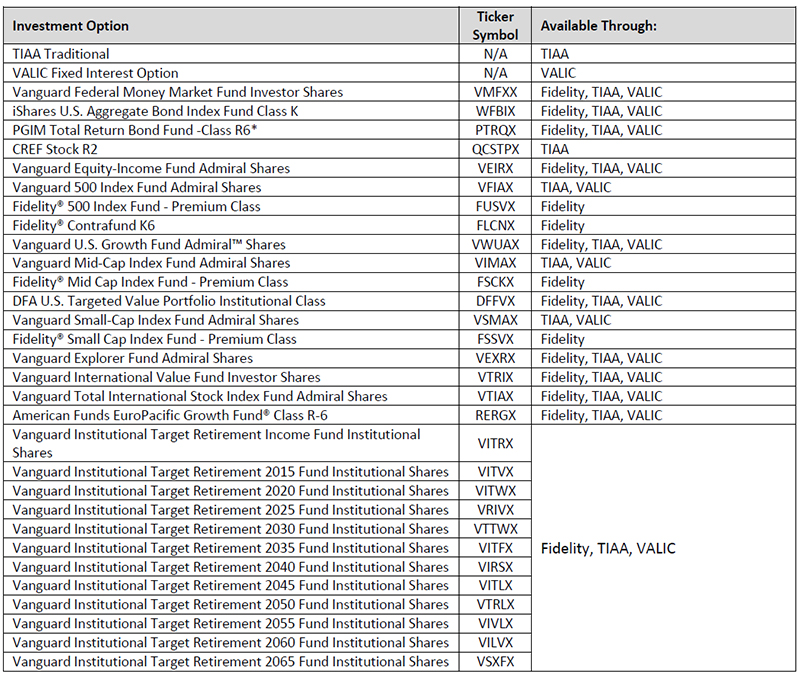

After you enroll, contact your Benefits Office to set up contributions. Talk with a retirement planner to get help with your financial goals. Remember Me Fidelity 403b investment options Need Help? Remember Me. Remember Me. Non-Profit Organization Retirement Plan A b plan allows eligible employees to save on a tax-deferred basis through salary deduction and also enjoy matching contributions from the employer.

Comments

Post a Comment