Because of the confluence of emotional and mental aspects required for these careers, investment firms often look for specific skills and characteristics in potential employees. I studied the behavioral questions, practiced technical questions, and went over as many brain teasers as I could. Related Terms Summa Cum Laude Summa cum laude is an academic level of distinction used by educational institutions to signify a degree that was received «with highest honor. But still, my curiosity got the best of me and, honestly, I was driven by the money, so I started doing my homework. A study by the U.

1. Research the Profession

Everyone knows banke investment banking is a lucrative field. Entry-level jobs quickly provide six-figure salaries. Senior professionals earn tens of millions of dollars every year. Getting to ivestment top of this field is a multi-step process that requires a combination of education, ambition, hard work, skillexperience, connections, and sometimes more than a little bit of luck. Here are suggestions for reaching the top. There are nearly 17, investment companies in the United States, but less than two dozen are significant on a global scale.

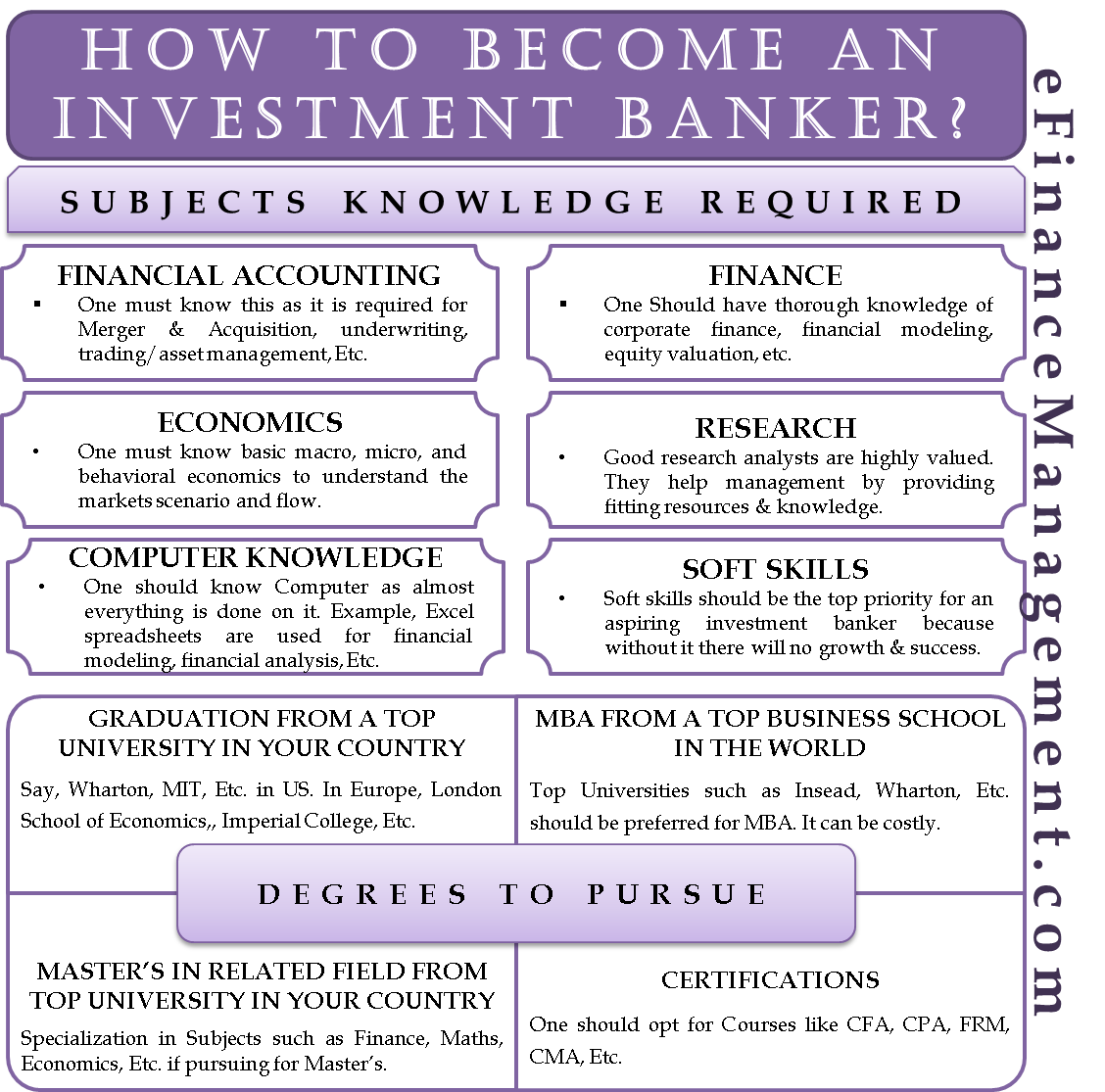

Investment bankers are intermediaries who help their clients — whether individuals, businesses, or governments — wisely invest their money. Investment bankers are also responsible for buying and selling stocks and securities on behalf of their clients. To become an investment banker, you must have a college degree, preferably in a related discipline. You also typically need professional certifications, as well as government licenses to buy and sell investment products for your clients. To become an investment banker, take business and economic classes to help prepare you for the field.

Everyone knows that investment banking is a lucrative field. Entry-level jobs quickly provide six-figure salaries. Senior professionals earn tens of millions of dollars every year.

Getting to the top of this field is a multi-step process that requires a combination of education, ambition, hard work, skillexperience, connections, and sometimes more than a little bit of luck. Here are suggestions for reaching the top. There are nearly 17, investment companies in the United States, but less than two dozen are significant on a global scale. Consider carefully whether you want to work for an international entity or a smaller company. A college degree in finance or economics is typically the starting point for entry-level jobs at an investment bank.

Accounting and business are also common educational backgrounds. Investment banks recruit from the best colleges and universities in the world. In the U. Can you go to a less prestigious institution and still achieve your goals? Sure you can, but just like choosing the right field of study, choosing the right school will help tip the odds in your favor.

The schools that investment banks recruit from are well known, so attending one of these schools is a matter of putting yourself in a position where you have the greatest likelihood of being noticed. When it comes to attracting notice, your grades are also important. Graduating at the top of your class will put you in a good position to draw the attention of campus recruiters and hiring managers.

A chartered financial analyst CFA certification can help. Internships provide a path for students and recent graduates to obtain full-time employment in just about every profession. Investment banking is no different. An internship gives you an opportunity to try out your desired field, gain exposure to the culture, get work experience, and impress potential employers.

Investment bankers spend their time selling. They find exorbitant amounts of money and convince people to give it to. They are the movers and shakers behind mergers and acquisitions of Fortune companies, initial public offerings of private companies that command stratospheric valuations, and other high-finance deals that generate enormous fees.

Networking is a critical part of the job, and perhaps even more so for those seeking to enter the field.

Long before you land your first megadeal you need to land a job. Selling yourself will be your first task, so every opportunity to do so is important. You need to mix and mingle with people who have the power to hire you or who can recommend you to people who do the hiring.

And you need to make a good impression. Of course, having a parent, uncle, cousin, or family friend who works in the business or has the right contacts never hurts.

The right words in the right ear can open doors. These people wear select clothes, drive select cars, and vacation in select places. They spend their time with people like themselves and give their money to people who understand them and share their culture.

A study by the U. If those things weren’t part of your background, it helps to be a quick study, at least to the extent of being able to blend in during your early years in this field, according to some included in the U.

After getting the best education, choosing your major, and networking like crazy, landing a job is an important step in the right direction. From there, keeping the job and advancing through the ranks are the next challenges. Staying in your job will require work weeks that routinely exceed 80 hours. Career Advice.

Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Careers Career Advice. Key Takeaways Getting a college degree from a top school, with a major in finance, economics, or something related to business is preferable.

Getting an MBA or some other advanced degree or certification in how to become a top investment banker will give you an edge over other candidates. Getting an internship at a top firm is critical for gaining exposure to the culture, on-the-job-training, a chance to impress potential employers, and networking.

Network like crazy to find a job. Industry groups, school, the company you intern for, or even family and friends can all be good sources of networking opportunities. Compare Investment Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Career Advice Job or Internship? Partner Links. Related Terms Summa Cum Laude Summa cum laude is an academic level of distinction used by educational institutions to signify a degree that was received «with highest honor. Millennials: Finances, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement.

Master of Business Administration MBA A master of business administration MBA is a graduate degree that provides theoretical and practical training for business management.

2. Get the Qualifications

It was a simple meet and greet. You need to mix and mingle with people who have the power to hire you or who can recommend you to people who do the hiring. Sure you can, but just like choosing the right field of study, choosing the right school will help tip the odds in your favor. They find exorbitant amounts of money and convince people to give it to. The right words in the right ear can open doors. But it goes beyond these basic core competencies. I went to a school that had limited on-campus events, but I made sure to find out when the banks were coming and whether I was invited or not, I was determined to go to the events. Personal Finance. An internship gives you an opportunity to try out your desired field, gain exposure to the culture, get work experience, and impress potential employers. What if I already missed the recruiting season — was there another way to get in? Combining that knowledge and understanding with an ability to communicate in more than one language is an added and sought after skill in investment banking.

Comments

Post a Comment