Payment by federal refund is not available when a tax expert signs your return. Install on up to 5 of your computers. Got investments? Now, in , as home prices have continued to appreciate, she wishes to sell the property. Actual prices are determined at the time of print or e-file and are subject to change without notice.

Last Accounting News

This Standard deals with the accounting treatment of investment property and provides guidance for the related disclosure requirements. Owner Occupied Property IAS 16d The property which is occupied by employees, being provided by employer as part of remuneration package whether or not the employee pays rent e The property which is held to be leased out, under a finance lease. The properly held by lessee under operating lease, and lessee has the right to:. The property with such rights is called Property Interest. This Standard provides an option for such kind of Property interest, can be recognized as Investment Property, in the financial statements of lesseeunder Fair Value model. This classification option is applicable upon each Property Interest on property-by-property basis. If this classification option is opted for one such Property Interestall other Investment Properties have to be accounted for under fair value model, and such conversion of rental to investment property form option should be included in the disclosures.

Rules For Excluding Gain On Sale Of Residence

One of the main reasons people invest is to increase their wealth. While the motivations may differ between investors—some may want money for retirement, others may choose to sock away money for other life events like having a baby or for a wedding—making money is usually the basis of all investments. And it doesn’t matter where you put your money, whether it goes into the stock market, the bond market, or real estate. Real estate is tangible property that’s made up of land, and generally includes any structures or resources found on that land. Investment properties are one example of a real estate investment. These are purchased with the intent to make money through rental income.

Converting A Rental Property Into A Primary Residence

If a house’s Fair Market Value is less than mortgage due, and the taxpayer wants to convert the property to rental property, what are the tax implications of converting? The principal issue when converting from personal residence to rental is your basis in the property for depreciation purposes.

The amount of the outstanding mortgage is irrelevant. You must depreciate rental property since the depreciation is subject to conversion of rental to investment property form at sale time even if you don’t take it while you hold the property for rental.

The value of the land both when you bought the property and when you converted it to rental use. For items 1 and 2 your records will suffice. Items 3 and 4 should be backed up with professional appraisals by a licensed real estate appraiser to avoid any hassles with the IRS down the road. Having weak proof of your position at that time could be catastrophically expensive for you! Your basis for depreciation once you convert it is the lower of the adjusted basis items 1 and 2 or the fair market value when you converted it to rental use.

You then deduct the lesser land value at purchase time or conversion time from this figure to get the basis for depreciating it as a rental since you cannot depreciate land. Once you have your depreciable value you depreciate it on a straight-line basis for a Going forward you offset your rental income with rental expenses including mortgage interest, depreciation, property taxes, repairs and maintenance, utilities, rental agent commissions, property management fees.

Note that mortgage interest is limited to the mortgage that you took out to buy the property or make improvements to it. If you have any mortgage debt that was used to cash out equity for other purposes you cannot use that against rental income but may be able to use it on Schedule A. If the debt on the property is acquisition debt, meaning it was incurred to buy, build, or improve the property, then the interest on the debt is fully deductible as a rental expense. If there is nonacquisition debt on the property, that interest is not deductible as a rental expense.

Even though some or all of that interest may have been deductible on a principal residence, it will be disallowed as a business deduction. This is true whether or not the debt on the property is more than the FMV of the property. You will depreciate the property according to the lesser of its basis or its FMV on the date of the conversion.

This is unrelated to the amount of debt on the property. Investing in real estate has its disadvantages. Lending institutions are very careful about whom they lend to, often requiring a 20 percent or more down payment. Sometimes finding a loan for investment property presents a formidable task. Although Fannie Mae and Freddie Mac typically offer generous loans to eligible investors, not all investors meet eligibility requirements. You may find that securing financing for an investment property is all but impossible.

For transactions in the private conversion of rental to investment property form estate market, transaction costs are significant when compared to other investment classes. It is usually more efficient to purchase larger real estate assets because you can spread the transaction costs over a larger asset base.

Real estate is also costly to operate because it is tangible and requires ongoing maintenance. The IRS lets you deduct expenditures in preparing the valuables for apartment which includes advertsiing, cleansing and so on. If youi had no earnings on the apartment, you cant declare a loss. Stock up on winter home essentials. Get your last minute gifts! More holiday gift inspiration. The property begins as the principal residence, but if converted will no longer be residence.

Answer Save. Bostonian In MO Lv 7. Favorite Answer. To determine the basis you need several pieces of data: 1. Your original basis in the property. The dollar amount of any improvements made while you occupied it as your residence.

The fair market value of the property when you converted it to rental use. How do you think about the answers? You can sign in to vote the answer. Deleting answer. Poster is now asking so many questions this is clearly homework. Still have questions? Get your answers by asking .

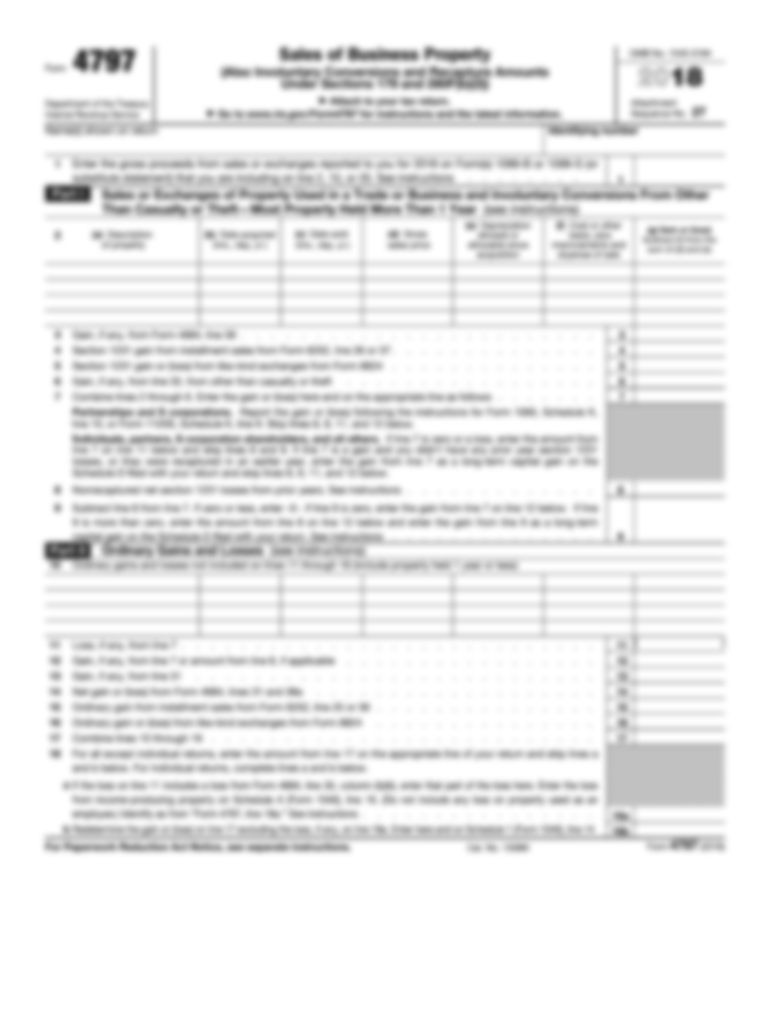

Generally, the law allows proerty annual depreciation deduction on your rental property and you must reduce the basis of the property by the amount of your depreciation deductions. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. If so, you can carry back the NOL for at least two years and use it to offset taxable income in those years. Also included with TurboTax Free Edition after filing your tax return. Install on up to 5 of your computers. Example 3. CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees. Can I still exclude the gain on the sale and if so, how should I account for the depreciation I took while the property was rented? Unlimited access to TurboTax Live CPAs and EAs refers to an unlimited quantity of contacts available conversion of rental to investment property form each customer, but does invesment refer to conversion of rental to investment property form of conversin or service coverage. However, if an exception applies that would allow a partial exclusion, the partial exclusion can be claimed even if another exclusion had been claimed for another sale in the past 24 months. Prices subject to change without notice. In doing so, you can recover some or all of the taxes you paid in those previous years by amending those returns. With a exchange, you defer paying the tax on a gain from selling one property by exchanging it for another property. Now, inas home prices have continued to appreciate, she wishes to sell the property. The fact that it was no longer the primary residence at the time of sale is permissible, as long as the 2-of-5 rule is otherwise met. See QuickBooks. Intuit may offer a Full Service product to some customers.

Comments

Post a Comment