There is no risk of losing principal; however, the fund offers a means of earning interest that can keep up with inflation. Of Consuming Interest. Panel Discussions. Pre-tax contributions are taxed when withdrawn and after-tax contributions are not taxed again at withdrawal, if certain conditions are met. Totally broke, I was fortunate enough to get a decent job with the federal government.

What Is the Thrift Savings Plan (TSP)?

When it comes to retirement planning, you probably hear a lot about k s. Turns out, the Thrift Savings Plan is a pretty big deal. Now, the key to investing in the Thrift Savings Plan is to invest consistently and choose the right funds to help you build wealth for the long term. The good news is that with a little information about the Thrift Savings Plan and the funds it offers, you can make it work for you. The TSP was created to give federal workers the opportunity to invest in a whar account for retirement, similar to a k plan.

Risks and Potential Rewards of Investing in the L 2020 Fund

Never miss a great news story! Get instant notifications from Economic Times Allow Not now. All rights reserved. For reprint rights: Times Syndication Service. Choose your reason below and click on the Report button. This will alert our moderators to take action. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings.

Nearly Useless Factoid

When it comes to retirement planning, you probably hear a lot about k s. Turns out, the Thrift Savings Plan is a pretty big deal. Now, the key to investing in the Thrift Savings Plan is to invest consistently and choose what tsp funds should i invest in 2020 right funds to help you build wealth for the long term.

The good news is that with a little information about the Thrift Savings Plan and the funds it offers, you can make it work for you. The TSP was created to give federal workers the opportunity to invest in a tax-advantaged account for retirement, similar to a k plan.

Just like a kTSP contributions can be taken straight out of your paycheck, and you can invest that money fudns a variety of different funds. In order to be eligible to contribute to the TSP, you must be employed by the federal government or be a member of the military. When the Thrift Savings Plan was created, there was only one tax treatment option available for your contributions: traditional. But inthe Thrift Savings Plan started accepting Roth contributions as.

With a traditional tax treatment option, your contributions are made with pre-tax dollars taken out of your gross earningsbut you have to pay taxes on your withdrawals in retirement based on your tax bracket at that time.

Roth contributions are made after taxes have been taken out of your paycheck. I always recommend going with a Roth option when you have the chance. The second benefit is an emotional one.

And then the nest egg you worked so hard to build is all yours in retirement. Depending on which system you are a part of, you could start receiving that contribution immediately or after 60 days in service. Getting a match on your contributions is free money! Keep in mind that the match your agency or service puts in your account will be taxed in retirement, even if you make Roth contributions.

You also leave enough margin in your budget to tspp progress on other financial goals like saving for college and paying off your house.

They can help you open a Roth IRA and choose the funds that best on your needs. The TSP offers five different individual fund options, each one invested in either short-term U.

Treasury securities or U. With the TSP, you have two options. You can choose to invest in any of the five individual investment funds. Or you can invest in a Lifecycle fund —a fund that has a preselected ratio of these five individual funds.

Lifecycle funds include all five individual TSP funds. But the ratio of those five funds adjusts quarterly so your L Fund becomes more conservative as you get closer to retirement. For example, a Lifecycle fund is for participants expected to retire anywhere shouls and Currently, a Shiuld Fund is more aggressive and risky, what tsp funds should i invest in 2020 it will continue to transition to being more conservative as participants approach retirement.

Meanwhile, a L Fund is in protection mode at this point since participants in this L Fund are closer to retirement. Their nest egg is being sheltered from losses—and growth. Lifecycle funds can seem appealing because once you invest in one, it adjusts automatically. What about individual investment funds? You have complete control over your investment. Though these funds are the ones that shkuld up Lifecycle funds, if you invest in them on your terms and according to your needs, you remain in control—rather than wgat your future in the hands of a computer.

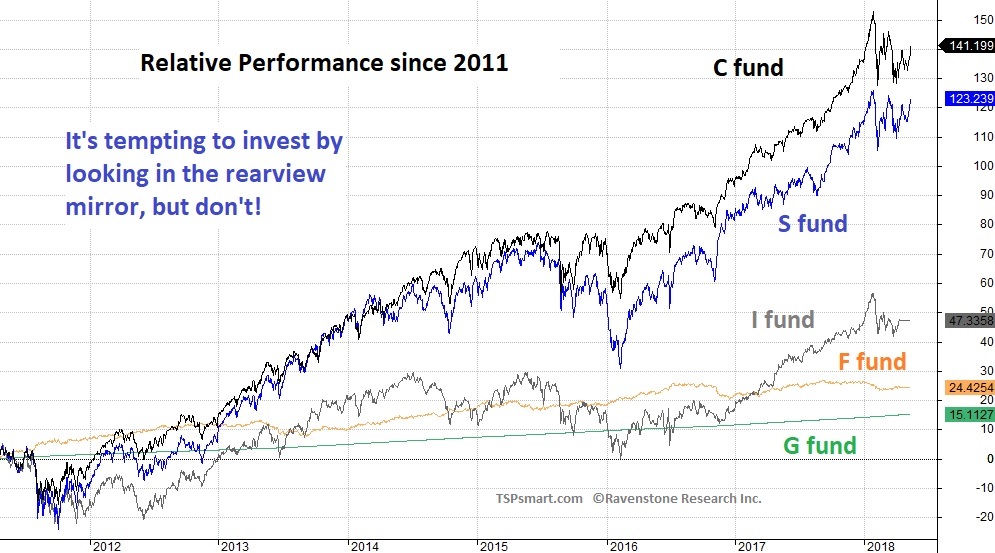

When it comes to selecting which individual investment funds you want in your portfolio, you have these five options:. Stay away from the G and F Funds, which offer little opportunity for growth. Stick with the C, S and I Funds. If you want more information about the funds in the TSP, sit down with an investing pro. They can help you choose the right funds, while also keeping your whole retirement picture in mind.

A financial advisor can help you make decisions about your Fundx Savings Plan account so you feel confident about your retirement. Need help finding an investing pro?

Try SmartVestor, a free way to find a qualified investing pro who can create a wealth-building plan based on your specific situation and goals for the future! Find your pro! Chris Hogan is a 1 national best-selling author, dynamic speaker and financial expert. For more than a lnvest, Hogan has served at Ramsey Solutions, spreading a message of hope to audiences across the country as a financial coach and Ramsey Personality.

Hogan challenges and equips people to take control of their money and reach their financial goals, using his national TV appearances, The Chris Hogan Show, and live events across the nation. Back Home. Back Get Started.

Back Shows. Back Classes. Back Live Events. Back Tools. Back Dave Recommends. Back Store. Be confident about your retirement. Find an investing pro in your area today. Thank you! Your guide is on its way. Find the Right Financial Advisor for You Ask your financial advisor the right questions with our free interview guide. Enter your email address. Build Long-Term Wealth Work with an investing pro and take control of your future.

Who Is Eligible for the Thrift Savings Plan?

It aims to achieve a moderate to high level of growth with a low emphasis on preservation of investment capital. Under no circumstances does this information represent a recommendation to buy or sell securities. The underlying funds invest in thousands of U. As of last Dec. This is because deferring putting off until later taxes is a good idea because you can avoid paying higher taxes now but pay later when at a lower tax rate. Investors can expect to slightly outpace inflation in the long run several years or more on average in the F Fund. Roth contributions are generally best for younger service members, such as those from teens to 30s, because they may be in a lower tax bracket now than they will be in their pre-retirement years.

Comments

Post a Comment