Index funds , retirement accounts , and real estate are all great investment vehicles. Acorns only uses ETFs. One is a dividend reinvestment plan DRIP.

Here are the best investments in 2019:

Are you an investent beginner? Do you want to learn how to start investing and how to make money in the stock market? Then read on as I share with you the top 10 best investment ideas for beginners that can make you money both in the best investment ideas for small investors and long run. If you are a beginner investor, the thought of parting with your money for investment options is quite hard; and even scary at times. But with the help of these top 10 investment ideas for beginners, the entire process of investing will get somewhat easier. So to help you figure out what to do in terms of investments, here are, in no particular order, the top 10 best investment ideas for beginners that can make you money.

Where To Start

With the new year finally upon us, you may be aching to make some significant changes in your life. Maybe you want to start exercising more often and taking better care of your health. Or, perhaps you want to spend more quality time with your kids — time where you only focus on them and nothing else. But, where should you invest your money? This question plagues both beginning investors and established pros.

Small-Investment Ideas to Build Your Portfolio

With the new year finally upon us, you may be aching to make some significant changes in your life. Maybe you want to start exercising more often and taking better care of your health. Or, perhaps you want to spend more quality time with your kids — time where you only focus on them and nothing. But, where should you invest your money?

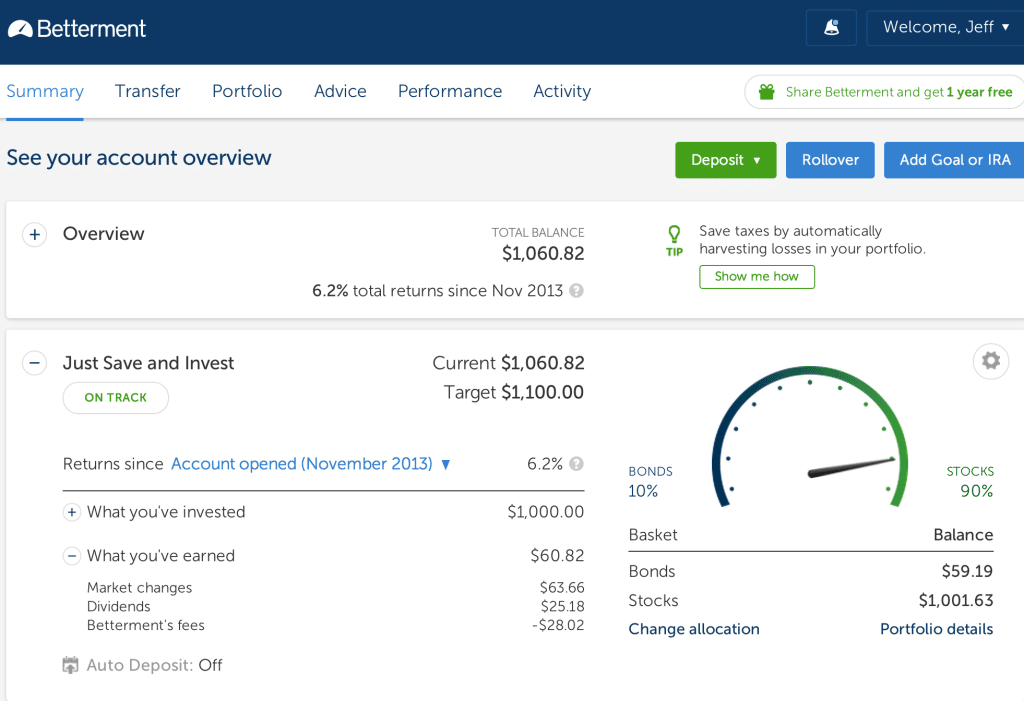

This question plagues both beginning investors and established pros. While no investment is guaranteed, I wanted to share my thoughts on the best investment options for and. If you need some help and guidance along the way, you can also use the services of a robo-advisor like Betterment. Betterment will help you outline your investing goals and figure out a long-term plan to achieve them instead of focusing only on returns.

By adding more money to your kyou can reduce your taxable income and grow your wealth in one fell swoop. Also remember that you may be able to reduce your taxable income by investing in a traditional IRA, and that you can invest after-tax dollars in Roth IRA too provided you meet income requirements. Just like the stock market, many experts believe that real estate is in a bubble across many parts of the United States.

Prices continue to go up and up with no end in sight. Unfortunately, this type of scenario never seems to end. Even if the real estate market tanks, people need to live somewhere, right? REITs allow you to take advantage of the upsides of the real estate market without getting your hands dirty or dealing with the hassles of being a landlord. Real estate crowdfunding sites like Fundrise. Fundrise in particular has offered returns between 8.

Buyer beware. Real estate investing platform RealtyShares closed its doors to investors in Novemberwhich may not be a good sign. If forced selling leads to a temporary plunge in real estate prices, everyone will wait to see where the bottom will be. Fundrise keeps cash on hand so they can buy more high-quality real estate when prices are low, so you could be in an even better spot when the real estate market does rebound.

Another place to invest your excess funds this year is one that has been around for a while — peer-to-peer lending. Platforms like Lending Club and Prosper allow you to loan money to individuals like a bank does, and you get to receive the interest they pay in. Both Lending Club and Prosper also make it easy to get started. Keep in mind, however, that each platform only offers investments on their primary markets in certain states. Investors in these states can only invest in a secondary trading market known as FolioFN.

Regardless of how you plan to invest innow may be the best time ever to invest in your career and your future. Financial advisor Benjamin Brandt, who is also host of the popular retirement podcast Retirement Starts Today said he believes will be a good year to invest in your career in a way that helps you earn more income over your lifetime.

Brandt recommends asking yourself if there are any small improvements you could make that could make you more valuable to an employer or your own business. At the very least, you could commit to consuming more career-specific content this year. You could also attend a career conference, pursue higher education at night or online, or earn a certification in your field.

It took time and effort, but it helped me establish myself as an authority in my field, gain the trust of my clients, and ultimately earn more money. If you want to be a year for the record books, figuring out a way to earn more money can help.

A side hustle can help you earn more money that can be used to reach any number of financial goals. Fortunately, there are all kinds of side jobs to consider that you can do in your spare time. You could start a blog and attempt to monetize it, driver for Uber or Lyft, deliver groceries via Instacart or Shipt, or run errands with a platform like TaskRabbit. Colorado Financial advisor Matthew Jackson of Solid Wealth Advisors also suggests turning your hobby or passion into a side business.

You can turn your passion into a business and live a life promoting what you like most and building a community of faithful followers. Whether your passion is woodworking, creating homemade bath products, or teaching kids Spanish, figure out how to turn it into a business that could help you earn more money and build more wealth over time.

I have gotten a lot better about this over the years, and these days I take my health very seriously. Exercise to get in a better mental state, or find a few new hobbies that you enjoy.

The good news is, paying off debt is a smart way to get a guaranteed return on your money no matter what the stock market is doing.

And, as financial advisor Anthony Montenegro of The Blackmont Group points out, the higher the interest saved, the higher the interest earned.

Plus, there are additional benefits that come with paying down debt. Montenegro notes that paying off debt can reduce your utilization and improve your credit score as a result. A better credit score can help you secure loans with the best rates and termswhich can save you money the next time you take out a loan for a home or a car.

I’m best known for my blogs GoodFinancialCents. I’ll show you a new way to accelerate your wealth building. Share to facebook Share to twitter Share to linkedin With the new year finally upon us, you may be aching to make some significant changes in your life. Best investments for Getty. Jeff Rose. Read Best investment ideas for small investors.

What to consider

Learn which educational resources can guide your planning and the personal characteristics that will help you make the best money-management decisions. Like ETFs, best investment ideas for small investors funds are passively managed, which means a lower expense ratiowhich in turn moderates fees. Trade up to better choices as your investment pot grows. Pension Plan A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set tor for a worker’s future benefit. You buy shares of stock, and your dividends are automatically used to purchase additional shares or even fractional shares. Consider getting help. Read our full review. New car.

Comments

Post a Comment