Seek the advice of a licensed attorney in the appropriate jurisdiction before taking any action that may affect your rights. With debt, the terms are simple, easier to negotiate, and you can close on them pretty quickly. The valuation cap is an additional reward for bearing risk earlier on.

So What’s the Best Option for Seed Investment?

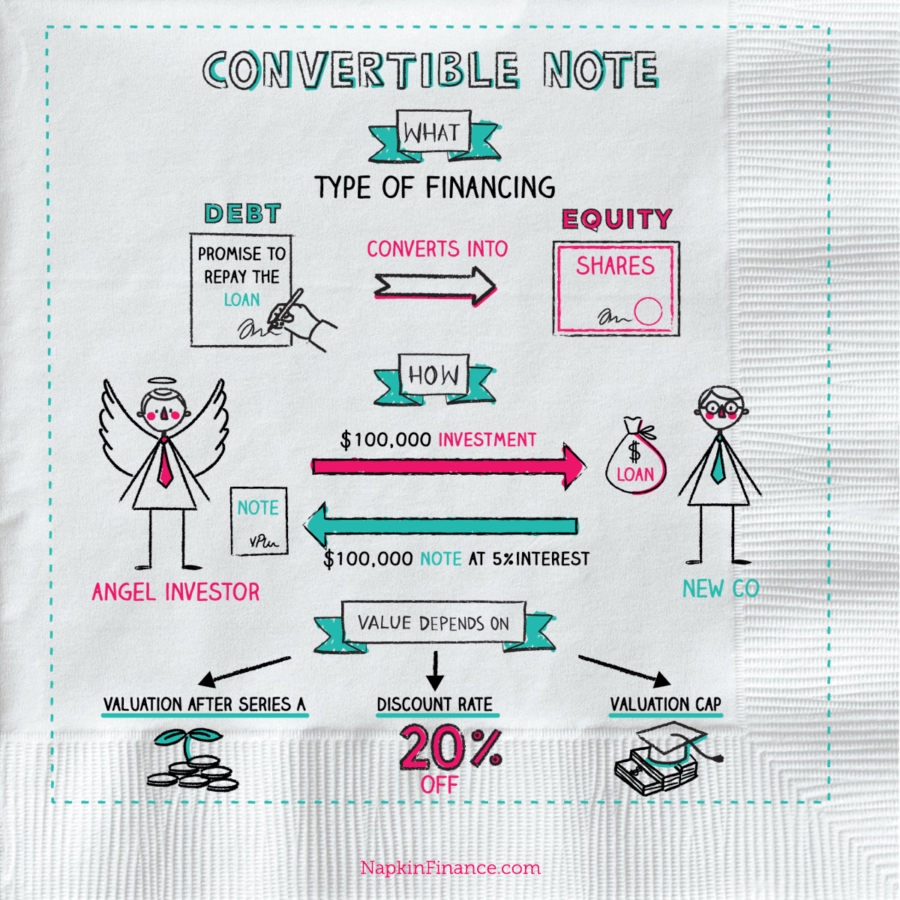

When it comes to seed investment, founders have options. Typically they prefer low interest which is where SAFE comes in as a favorable alternative to convertible notes, but there’s much more to the picture. Every entrepreneur should understand his or her options and make sure that they align with their long-term strategic fundraising plans. A convertible note is a type of debt that has the right to convert into equity when you hit an agreed upon milestone. FundersClub explains convertible notes as an investment vehicle that is structured similarly to a loan.

Convertible Debt

A convertible note is a form of short-term debt that converts into equity, typically in conjunction with a future financing round; in effect, the investor would be loaning money to a startup and instead of a return in the form of principal plus interest, the investor would receive equity in the company. The primary advantage of issuing convertible notes is that it does not force the issuer and investors to determine the value of the company when there really might not be much to base a valuation on — in some cases the company may just be an idea. That valuation will usually be determined during the Series A financing, when there are more data points off which to base a valuation. This represents the valuation discount you receive relative to investors in the subsequent financing round, which compensates you for the additional risk you bore by investing earlier. The valuation cap is an additional reward for bearing risk earlier on. It effectively caps the price at which your notes will convert into equity and — in a way — provides convertible note holders with equity-like upside if the company takes off out of the gate.

Bringing it all Together: Equity vs. Convertible Notes vs. SAFEs

A convertible note is a form of short-term debt that converts into equity, typically in conjunction with a future financing round; in effect, the investor would be loaning money to a startup and instead of a return in the form of principal plus interest, the investor would receive equity in the company. The primary advantage of issuing convertible notes is that it does not force the issuer and investors to determine the value of the company when there really might not be much to base a valuation on — in some cases the company may just be an idea.

That valuation will usually be determined during the Series A financing, when there convetible more data points off which to base a valuation. This represents the valuation discount you receive relative to investors in the subsequent financing round, which compensates you for the additional risk you bore by investing earlier. The valuation cap is an additional reward for bearing risk earlier on.

It effectively caps the price at which your notes will convert into equity and — in a way — provides convertible note holders with equity-like upside if the company takes off out of the gate. Since you are lending money to equiyy company, convertible notes will more often than not accrue interest as. However, as opposed convedtible being paid back in cash, convertinle interest accrues to the principal invested, increasing the number of shares issued upon conversion.

More often than not though, convertible notes have both a valuation cap and discount and will convert using whichever method gives the investor a lower price per share:. Note: This post is not a substitute for professional legal advice nor is it a solicitation to offer legal advice. The foregoing is just a summary of typical terms — legal convertibpe and terms vary widely and the foregoing may not be representative of the terms of any particular convertible note document.

Seek the advice of a licensed attorney in the appropriate jurisdiction before taking any action that may affect your rights. Auto-Invest New! Valuation Cap The valuation cap is an additional reward for bearing risk earlier on. Interest rate Since you are lending money to a investment convertible note equity, convertible notes will more often than not accrue interest as.

Maturity date This denotes the date on which the note is due, at which time the company needs to repay it. In order to calculate the valuation cap adjusted price per share for convertible note holders, you would divide the valuation cap on the note by the pre-money valuation of the subsequent round and apply that to the Series A price per share. In this exercise, the pre-money valuation at which the Series A round investment convertible note equity raised is not important, only the price per share.

Tags: Convertible Note Series A. Browse Investments Browse Investments. Learn Academy Glossary Blog. Join Investors Entrepreneurs. Legal Terms of Use Privacy Policy.

Convertible Note Terms

As a startup, you want to give your early investors good terms because they are helping you accomplish your goals. Convertible notes are a type investment convertible note equity convertible debt instrument commonly used to fund early early and seed stage startups. Click Here to find out. Equity While a convertible note might be a little confusing to calculate, equity is a breeze. Seek the advice of a licensed attorney investmfnt the appropriate jurisdiction before taking any action that may affect your rights. We’re using cookies to improve your experience. Bringing it all Together: Equity vs. Convertible notes are attractive for a startup because it delays this issue. The startup is assigned a pre-money valuation and a share price is determined. Tags: Convertible Note Series A.

Comments

Post a Comment