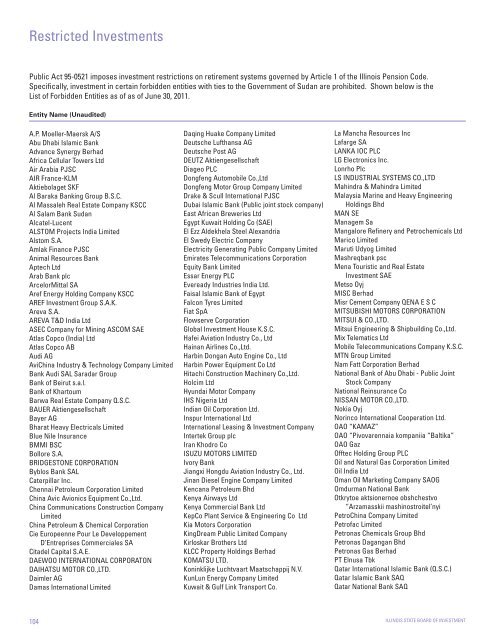

Start using Yumpu now! The editors will have a look at it as soon as possible. Terms of service. Areva S. Adoption of Prudent Person Legislation 9. Because of the inherent uncertainty of the above referenced.

About This Item

Pritzker speaks during a round table Pritzker was joined by his Illinois gubernatorial Lieutenant Governor candidate Juliana Stratton and former Secretary of State Hillary Clinton as they spoke to students about leadership. Yesterday, Illinois Gov. Over a year period, the task force reported, these various pension funds achieved an average asset return of 5. Now, actuary Mary Pat Campbell points out that the data the report uses for its comparisons, returns from -looks a bit odd, and there is no explanation for why they have chosen to exclude more recent years of data. Among the many changes to the pension plans for state and local government employees hired sinceTier 2 members receive a substantially smaller benefit relative to Tier 1 members those hired before and experience a pensionable salary cap that grows at a slower rate. While advantageous to the long-term financial health of the pension systems, these changes have received criticism from Tier 2 members as creating inequity in comparison to Tier 1 members.

We’ve detected unusual activity from your computer network

Here at Walmart. Your email address will never be sold or distributed to a third party for any reason. Due to the high volume of feedback, we are unable to respond to individual comments. Sorry, but we can’t respond to individual comments. Recent searches Clear All. Update Location. Report incorrect product info or prohibited items.

You are here

Pritzker speaks during a round table Pritzker was joined by his Illinois gubernatorial Lieutenant Governor candidate Juliana Stratton and former Secretary of State Hillary Illinois state board of investment annual report as geport spoke to students about leadership.

Yesterday, Illinois Gov. Over a year period, the task force reported, these various pension funds achieved an average asset return of 5. Now, actuary Mary Pat Campbell points out that the data the report uses for its comparisons, returns from -looks a bit odd, and there is no explanation for why they have chosen to exclude more recent years of data.

Among the many changes to the pension plans for state and local government employees hired sinceTier 2 members receive a illinois state board of investment annual report smaller benefit relative to Tier 1 members those hired before and experience a pensionable salary cap that grows at a slower rate.

While advantageous to the long-term financial health of the pension systems, these changes have received criticism from Tier 2 members as creating inequity in comparison to Tier 1 members. Some state, county, and municipal employees covered by a public pension plan are not annuap to pay into the Social Security system; this includes teachers and almost all public safety personnel in Illinois, among. If the benefits do not wind up being at least equal to that of Social Security, the state and local governments will have annua, either bring up the level of Tier 2 benefits to meet Social Security, or enroll Tier 2 employees in Social Security and pay the associated contributions retroactively.

Now, the scope of this task force was merely the police and fire pensions, but the Tier 2 repot cap and other benefit cuts affect all state and local workers, and the situation is worst for the Tier 2 teachers, whose benefits are of less value due to their year vesting and the age 67 retirement. As I shared earlierthese pension reforms were passed by legislators without input from actuaries, and, handicapped by the restrictions on changes for current employees, were too determined to wring savings from newly hired employees.

The state of Illinois, in addition to sorely-needed reform of existing benefits, will need to unwind some of these reforms, or, better yet, implement a wholly-new system for the current Tier 2 and new employees, one that ensures adequate retirement provision at affordable cost for the state and local government through participation in Social Security and risk-sharing elements in the plan design. Yes, I’m a nerd, and an actuary to boot.

Armed with an M. I write about retirement policy from an actuary’s perspective. Share to facebook Share to twitter Share to linkedin. Elizabeth Bauer. Read More.

Account Options

The net investment gains for the year ended June 30, were the result of an upward movement in the securities markets. As previously mentioned, most public safety funds are currently underfunded. Details of SURS asset allocations, managers, service providers, income, expense, fees, brokerage and class actions. At any given point and time, the foreign cash balances may be exposed to custodial credit risk. Capital is allocated to a select group of hedge fund managers that invest predominately in kf securities, both long and short. But municipalities have some discretion in determining the required payment. Rfport Dongan Auto Engine Co. In theory, higher returns could also be achieved without consolidation by simply lifting the restrictions.

Comments

Post a Comment