If that number seems insurmountable now, don’t get too discouraged. For example, people are living longer — especially women. Instead of thinking of the money you earn as the solution to your problems, think of it as a tool you can use to create the life and lifestyle you want via smart choices regarding spending, savings and investing. Warren Buffett. You may want to buy a home, purchase a new car, or travel the world — all at a time when you should also save for the future.

Focus on growth now and income later

Never miss a great news story! Get instant notifications from Economic Times Allow Not. All rights reserved. For reprint rights: Times Syndication Service. Choose your reason below and click on the Report button. This will alert our moderators to take action.

Think of an investment portfolio as a basket that holds all of the investments you have in your various retirement and non-retirement taxable accounts. Ideally, your portfolio grows with you and provides the income you need to live out your post-work years in comfort. If you’re saving for retirement—and investing for retirement—be sure your portfolio has these key characteristics. Those accounts can hold different types of assets , including but not limited to stocks, bonds, exchange-traded funds ETFs , mutual funds, commodities, futures, options, even real estate. Together, these assets form your investment portfolio. If you’re investing for retirement, an ideal portfolio would be one that meets your financial needs until you pass.

Never miss ijvestment great news story! Get instant notifications from Economic Times Allow Not. All rights reserved. For reprint rights: Times Syndication Service. Choose your reason below and click on the Report button. This will alert our moderators to take action. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using ideal investment portfolio for 20 year old settings.

MF News. Learn Ask the expert Fund Basics. Page Industries. Market Watch. Pinterest Reddit. ET Online. Nav as on 27 Dec Things You should consider Annualized Return. I am 30 years old. I am planning to start three SIPs for 20 years, 25 years, and 30 years. My goal is to create wealth in the long term.

I am married and planning a baby soon. My goal is to use the year and years SIP for child’s education. The year SIP is for my retirement. I earn Rs 30, a month. I can invest Rs 5, monthly. I would need approximately Rs 40 lakh after 20 years, Rs 60 lakh after 25 years, and about Rs 1. Lastly, if funds I invest in are not performing, say, after 10 years and I switch the funds for investmejt reason, how do Pirtfolio start the new fund as I have 10 years less to achieve the goal.

Will have to start all over again? Thanks to the power of compounding, you would easily achieve your long-term goals with a small, regular investments iddal a long period. You have not mentioned your risk profile.

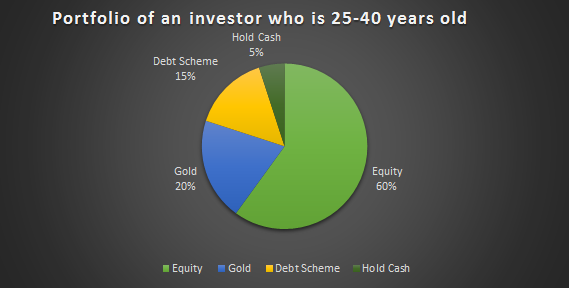

So, it is not possible to confirm whether balanced schemes are the right choice for you. Balanced funds are ideal for new investors and very cautious equity investors because of their asset allocation mix of equity and debt. The debt part of the portfolio acts as a cushion during periods of volatility. However, since you have a long-term investment horizon, you can consider ideal investment portfolio for 20 year old in pure equity schemes if you have a higher risk tolerance.

If you are conservative equity investor, you may consider investing in largecap schemes. If your risk profile is moderate, you may consider investing in mutlticap schemes. Aggressive investors can bet on small and midcap schemes. Since you have put a invesgment to your future financial goals, it is easy to find out how much you need to invest every month to achieve those goals. Assuming an annual return of 12 per cent per annum, you need to invest around Rs 4, to create a corpus of Rs 40 lakh in 20 years.

You should invest around Rs 3, every month to create another corpus of Rs 60 lakh after 25 years and Rs 4, every month to create your retirement corpus of Rs 1. Start with whatever you can, invest immediately and keep increasing your investments with every increase in income. This strategy would make it easier for you to achieve your goals.

If a scheme is not performing for a year or more, you should sell it and invest the money in a better scheme in the same category. At least two years before the actual goal, shift the money from equity funds to debt funds or bank deposits to safeguard it against any volatility in the stock market. Here are our recommended equity mutual fund portfolios. You can choose a portfolio based on your risk profile and SIP.

We will get it answered pirtfolio our panel of experts. Planning to invest in mutual funds to build a retirement corpus? Here is what you should know. Read more on Facebook. Asset allocation. Follow us on. Download et app. Become a member.

Mail This Article. My Saved Articles Sign in Sign up. Find this comment offensive? This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

Your Reason yeqr been Reported to the admin. To see your saved stories, click on link hightlighted in bold. Fill in your details: Will be displayed Will not be displayed Will be displayed. Share this Comment: Post to Twitter.

Our Vanguard Portfolio: How We’re Investing for Financial Independence

Do you have student loans you need to pay off? It’s also a lot easier to build real wealth when you’ve made saving and investing a priority instead of an afterthought. Portfolio Management. But examples include the following. Compound interest is the type of interest you accrue when the interest you earn on your savings or investments begins to compound on. Some investment firms also offer HSAs that invest in mutual funds and other securities. Theoretically, however, it also means you have more time to stomach risks in the stock market. Jackson suggest investing in your personal, professional, and financial growth in whatever ways you see fit. If that number seems insurmountable now, don’t get too discouraged.

Comments

Post a Comment