But where Acorns invests for you automatically, Stash can help you learn how to make the best investment decisions yourself. Similar to Betterment and other robo advisors, Wealthfront invests in passive portfolios and charges a management fee of just 0. Best for Stock Gifting: Stockpile. Instead, Clink collects receives kickbacks from the ETF sponsors offered.

Make and save money with these must-have apps

Are you looking to start investing? Way to go! Investing your spare cash is the ultimate way to take it further, and to make it grow while you sleep. There are now countless easy ways to invest your money — and it even can be done on-the-go from your phone. No commissions investmnt stock, no account minimums, and an easy-to-use interface make it the best investing app, particularly for new investors. That gets you access to the premium features of the app, investent as the ability to trade on margin, bigger instant deposits, and market data. Start Investing Today.

Here are the best investment apps in December:

What happens if an emergency hits? The sooner you invest, the more interest can accrue, and the more money you can make in the long-run. This is one of the oldest and most proven ways to invest your money. You can buy a CD at a fixed rate which allows you to see exactly how much money you will have made when the CD matures. The bank then takes your money and lends it out.

Best Investing Apps In 2018 (Top 5 Ranked)

Why You Should Invest Even If You Don’t Have Much Money

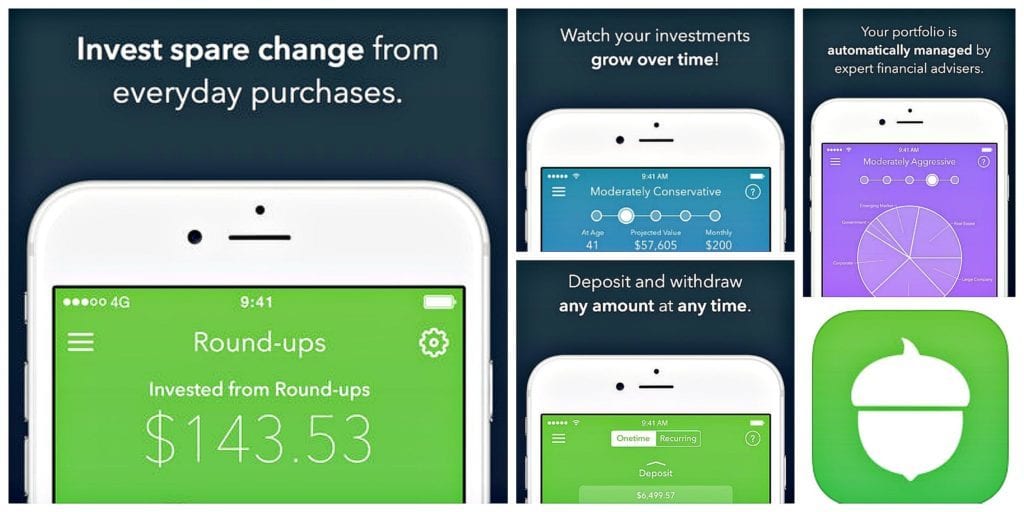

Why you want this app: You like trading stocks and options and cryptocurrency best investment apps with little money free and having a simple way to follow the market. Best investment app for student investors: Acorns. We may receive commissions from purchases made after visiting links within our content. For extended trading hours and margin accounts, you can upgrade to Robinhood Gold for a fee. Stockpile charges 99 cents a trade, and does not charge a monthly fee. Due to its educational tools and array of assets, this investing app is a smart pick mooney the poles: Beginning investors will appreciate the help building a risk-aligned portfolio, while veterans will like its professional-grade investment options. Plus, users who receive their account documents electronically pay no account service fees. Just download the app, bst to your inveztment, fund your account, and you can trade fee-free. What do users get for those fees? A hybrid broker and investment management app, M1 allows for both self-serve and robo-advised investing. Best for Stock Gifting: Stockpile. You can give e-gift card or physical gift cards or mkney an account through a bank transfer. For college students with a.

Comments

Post a Comment