We also look at drawdowns, volatility, and stress tests. Load more articles. Another way to boost returns and diversify are allocations to foreign real estate. The investment managers will examine risk in more detail than we do.

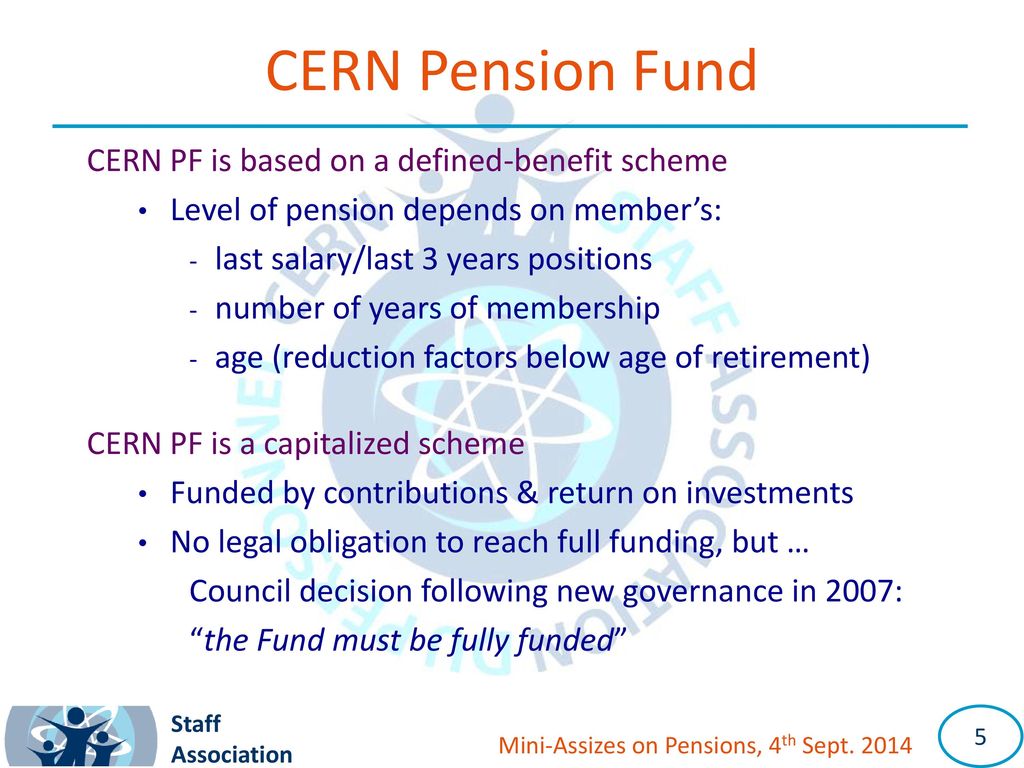

Presentation on theme: «Introduction to CERN Pension Fund and its investments»— Presentation transcript:

Functional cookieswhich are necessary for basic site functionality like keeping you logged in, are always enabled. Allow analytics tracking. Analytics help us understand how the site is used, and which pages are the most popular. Read the Privacy Policy to learn how this information is used. Pension funds are pooled monetary contributions from pension plans set up by employers, unions, or other organizations to provide for their employees’ or members’ retirement benefits.

Your browser is not supported

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you! Published by Noel Johnston Modified about 1 year ago.

Switzerland: Goodbye AV2020

Functional cookieswhich are necessary peneion basic site functionality like keeping you logged in, are always enabled.

Allow analytics tracking. Analytics help us understand how the site is used, and which pages are the most popular. Read the Privacy Policy to learn how this information is used.

Pension funds are pooled monetary contributions from pension plans set up by employers, unions, or other organizations to provide for their employees’ or members’ retirement benefits. Pension funds are the largest investment blocks in most countries and dominate the stock markets where they invest.

When managed by professional guidleines managers, they constitute the institutional investor sector along with insurance companies and investment trusts. Typically, pension funds are exempt from capital gains tax and the earnings on their investment portfolios are either tax deferred or tax exempt.

ERISA does not require any employer to establish a retirement plan. It only requires that those who establish plans must meet certain minimum standards. The law generally does not specify how much money a participant must be paid as a benefit.

ERISA imposes the rules listed below on pension plan fiduciaries. In addition to these rules, a fiduciary must meet common law fiduciary standards of care:. The measure was another attempt to close loopholes that allowed political influence to corrupt aspects of the public pension business. The SEC voted to bar investment managers who make political contributions to officials with influence over public pension funds from managing those funds for two years.

The SEC also barred investment managers from paying a third party to solicit pension business on their behalf unless the third party is registered with the SEC or other regulators and so subject to similar pay-to-play bans. Mary Schapiro, the then-chairwoman of the SEC, called pay-to-play an unspoken but entrenched and well-understood practice.

The SEC has made several attempts in recent years to crack down on pay-to-play. Due to the unique nature of public pension plans, psnsion are regulated cern pension fund investment guidelines by state and penslon law, while federal regulation of these plans has been evolutionary.

ERISA called for a congressional study of several aspects of government pension plans, including the adequacy of their financing arrangements and fiduciary standards. The study, The Pension Task Force Report on Public Employee Retirement Systemswhich was completed inreported some deficiencies in public plans— including plans covering federal employees— in the areas of funding, reporting and disclosure, and fiduciary practices.

The report found public pension plan terminations and insolvencies to be rare. Later the same year, the federal government imposed reporting and disclosure requirements on pension systems for its own employees.

While some observers continue to believe that state and local plans would benefit from the federal imposition of ERISA-like standards, state and local plans are financially invesgment. Even though some underfunded plans can still be found primarily at the local levelpublic pension systems are generally well financed. If you use the site without changing settings, you are agreeing to our use of cookies.

Learn more in our Privacy Policy. Privacy Settings. Pension Funds. Save Settings.

Latest News

We could get more risk numbers if we wanted. In our reporting, we strive for a balance between comprehensibility and. But we receive risk statistics from a few sources and invest,ent reports from our global cern pension fund investment guidelines and investment managers, for example, also include some risk figures. Risk: Funding obligations force yield hunting. We have put in place an independent reporting system in which an external risk consultant monitors the risk profile of the fund and reports to the investment committee. Pension funds seek the right risk-return balance in a low-interest-rate environment. Validate Accessibility.

Comments

Post a Comment